As a nascent profession, it is not surprising that different companies view the role of their customer success organizations differently. Although this may be the case for a long time to come, there are a series of questions that can help you decide what customer success means for your company today. It is critical to understand up front that the questions below don’t have generic answers. They aren’t directions for manufacturing silver bullets or instructions for building a magic wand. They are good questions in and of themselves, but their greatest value may be the other questions they raise, and the discussions that result while you are considering them.

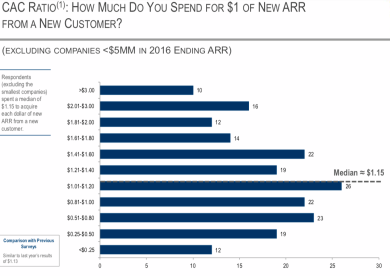

If you look at other organizations within SaaS companies, there are guidelines for what should be invested. Sure within these guidelines expenditures are reviewed and justified (marketing attribution is a great example) but the overall investment amount is rarely a “Bottoms Up” exercise. As an example: A commonly used guideline for how much it should cost to acquire one dollar of recurring revenue is one dollar. Look at the figure to the right. Based on research from 240 privately held companies whose ARR  ranges from $5M to >$100 M the median amount of money spent for a dollar of new customer ARR is $1.15 (CAC ratio). This type of metric is not unique; there are plenty of others. If you look at the ratio of sales to marketing dollars spent, it is about 70/30. Of course, all of these ratios are impacted by factors like your sales strategy (internet sales being almost the inverse proportion), but industry average targets do exist. Some categories in your income statement such as R&D decrease as your company grows (29% $5 M ARR – 22% >$60 M ARR). Others stay pretty much the same, like Cost of Goods Sold (COGS) which is fairly constant (~25%). That is why, when Customer Success leaders are asked to “Justify the cost of Customer Success”… I cringe. That’s not the way businesses typically approach these high-level questions for other organizations, why would Customer Success be different. The answer is that it shouldn’t be. The same sort of guidelines should exist for things like renewals and expansions (CRC/CEC ratios). Unfortunately for Customer Success, these guidelines are pretty much non-existent. What’s even worse is that these critical financial metrics are rarely even measured. You would never do this for something like your Customer Acquisition Cost ratio. When you approach a market, companies always set revenue targets and commit to growth rates, they decide on the sales and marketing spend to hit these targets. The same is not usually done for customer success, and that is a mistake.

ranges from $5M to >$100 M the median amount of money spent for a dollar of new customer ARR is $1.15 (CAC ratio). This type of metric is not unique; there are plenty of others. If you look at the ratio of sales to marketing dollars spent, it is about 70/30. Of course, all of these ratios are impacted by factors like your sales strategy (internet sales being almost the inverse proportion), but industry average targets do exist. Some categories in your income statement such as R&D decrease as your company grows (29% $5 M ARR – 22% >$60 M ARR). Others stay pretty much the same, like Cost of Goods Sold (COGS) which is fairly constant (~25%). That is why, when Customer Success leaders are asked to “Justify the cost of Customer Success”… I cringe. That’s not the way businesses typically approach these high-level questions for other organizations, why would Customer Success be different. The answer is that it shouldn’t be. The same sort of guidelines should exist for things like renewals and expansions (CRC/CEC ratios). Unfortunately for Customer Success, these guidelines are pretty much non-existent. What’s even worse is that these critical financial metrics are rarely even measured. You would never do this for something like your Customer Acquisition Cost ratio. When you approach a market, companies always set revenue targets and commit to growth rates, they decide on the sales and marketing spend to hit these targets. The same is not usually done for customer success, and that is a mistake.

I get a lot of questions about the best way to justify an additional CSM, or the amount that should be invested in customer success automation and when. These are important questions, but I believe there is a better way to approach these issues than a cost justification. The following questions are designed to help address these questions, and many others, from a different perspective that can be extremely valuable to you, your team, and your company. Companies can say how much a dollar of new revenue is worth to them. Customer Success should be able to answer the same questions for renewals and expansions. When they can, amazing things will result from it!

The 5 Questions

#1. What is the value of a dollar of renewed revenue? (CRC ratio – $/$)

So the first question is focused on the topic I started to discuss above. It’s really important to establish what a dollar of renewal is worth. We have this number for new customer acquisition and that makes perfect business sense. The same is true for renewals…. but this is not just a matter of equality or parity, it is required to run your customer success organization efficiently and effectively. But before we talk about a budget… There is one issue we need to address. Many of your brains at this point will be screaming: “A BUDGET… Are You Crazy”? We’re a startup; we’re lean, we’re mean and most of all we’re agile, we may need to pivot on a dime, and we can. A budget is like a ball and chain. A Budget = A Bureaucracy! First off you need to consider this budget as a guideline. We’re not talking about a chart of accounts, separate department numbers, expense allocations, etc… We are talking about a framework. This may scare you but trust me, there is nothing more frightening than the statement, “Oh don’t worry, our customers are our number one priority… Just tell me what you need when you need it”! Still not convinced, then consider this. Having a “budget” establishing your CAC ratio, doesn’t restrict you, it is a wealth spring of innovation. Let me explain why. If I tell you to make a plan to drive gross churn, advocacy, or expansion, what do you do? Can you do anything you want? Is CS somehow exempt from the reality that all businesses are faced with the challenge of how to best apply limited resources to an unlimited number of challenges? I assume you’re all smart people (if not, I would guess you’d have stopped reading this a while ago 🙂 If I tell you what you need to do, and I tell you what resources you have to do it, you’ll figure out a way to get it done. You know it. You’ll be clever, you’ll be innovative, you’ll not only get it done… you’ll crush it. If on the other hand, the resources you have to get the job done won’t cut it, it’s time to get more resources, limit the scope of your responsibilities, or start asking your network if they know about anyone looking for a CS executive. You need resources to succeed, period. When you know what resources you have to work with, you can do things like look at your customer segments and assign the right resources to the right customers based on their importance to your company. This way you won’t have your team spending all of their time with the “wrong customers”. You’ll also know what customers are not profitable, and then you won’t need to veto sales. Then you can have a conversation that isn’t about what sales does, it’s about getting leadership consensus around the issue of closing deals that you lose money on? The list goes on and on… but this blog shouldn’t, so here comes question #2.

#2. What is the value of a dollar of expansion revenue?

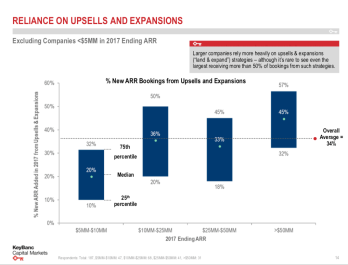

The train of thought here is similar to the one above, but it has some subtleties that are worth noting. It’s often stated that a dollar of revenue from a new customer is 5 to 7 times more expensive to acquire than a dollar of new revenue from an existing customer. Sounds great, but this isn’t a law of nature. You have to make this happen. Just to make the math easy, let’s back into the 5X number. If your CAC ration is $1.00 then you’re spending a buck for each dollar of ARR from a new customer. If that’s the case, then you get $0.20 for a dollar of expansion revenue. Ok, so how do you make that happen? It may be your company’s perspective that sales should “close all of the deals” and that’s great as long as you have a comp plan in place that lets them do that for $0.20. If you do that’s great. This isn’t about a land grab for power; it’s about building a great company. On the other hand, if you can’t do it for $0.20 that ok too, but then your goal isn’t 5X. So maybe it’s not 5x now because your expansion is a small part of your revenue growth, and that may make sense today, but take a look at the research from Pacific  Crest to the right. Once you’re over $10M in ARR existing customer expansion is about a third of new revenue. Once you get >$50M it can be more than half, and this is “new revenue”, having nothing to do with retention. It may not matter today (and I mean that) but you need to understand when the new revenue from the existing customers is huge, how much do you want to spend to acquire it. When the expansion revenue number gets large will the goal be $020? If yes, then you need to ask yourself, will sales make this happen or will it be CS? If the answer is CS, you need to think about and plan for this today! If this is the plan, you have to ask yourself: “Am I hiring the right people now for the skillset I’ll need in 18 months”? This is not just a hypothetical scenario, it happens and the result is often a CS train wreck. Right now 2X vs. 5X may not seem like a big deal, but it increases your net burn, and that results in the need to raise more capital, and that dilutes your equity… This is more than something worth considering. The topic may be dismissed the first time around, but it is a conversation you want to revisit periodically. I’m pretty confident it won’t be a popular topic, but it’s your responsibility when you have a “seat at the table” and are part of the leadership team.

Crest to the right. Once you’re over $10M in ARR existing customer expansion is about a third of new revenue. Once you get >$50M it can be more than half, and this is “new revenue”, having nothing to do with retention. It may not matter today (and I mean that) but you need to understand when the new revenue from the existing customers is huge, how much do you want to spend to acquire it. When the expansion revenue number gets large will the goal be $020? If yes, then you need to ask yourself, will sales make this happen or will it be CS? If the answer is CS, you need to think about and plan for this today! If this is the plan, you have to ask yourself: “Am I hiring the right people now for the skillset I’ll need in 18 months”? This is not just a hypothetical scenario, it happens and the result is often a CS train wreck. Right now 2X vs. 5X may not seem like a big deal, but it increases your net burn, and that results in the need to raise more capital, and that dilutes your equity… This is more than something worth considering. The topic may be dismissed the first time around, but it is a conversation you want to revisit periodically. I’m pretty confident it won’t be a popular topic, but it’s your responsibility when you have a “seat at the table” and are part of the leadership team.

#3. Will customer success own retention and expansion revenues?

This is a question that helps clarify the previous two. Just to be clear when I say, “own” I mean forecast, commit and close. You need to know this. It’s great to know you have $0.15 for a renewal, but you need to understand if 1/3 of that goes to sales. Why is the forecast important? To understand that you need to ask yourself: Do you “monetize the value you create for your customers”, or do you sell them stuff? If you make more money because your customer is more successful, because you are creating more value, then different people need to create the forecast in a different way. If you sell to your customers, you have a “nut”. When you sell, the job is to hit a number. Just be aware that this can affect churn, advocacy, and the brand… and that is your business.

#4. Does your revenue expansion come from adding business value?

I’m not saying CS should own everything. I’m just highlighting questions that will help you answer what they should own and why. There is a fundamental question about how you sell, and how you expand. If you sell on features, if your ideal customer is one that’s feeling the pain, that is what you focus on during a sales cycle. If they don’t churn, then I assume the pain is gone… Correct? Then what is the compelling reason they continue to spend money with you? Is this a business case? If so, who talks about these business issues with the customer? If I’m the customer and you know my business, you help me be more successful, and I trust you. If you’re my “trusted advisor” then I’ll take your advice. The entire landscape changes when a prospect becomes a customer. One, they know the reality of how well your stuff works, but more importantly the entire competitive landscape changes. During the sale cycle, you know your competitive landscape. You do competitive intelligence on companies that sell to solve the same problem. Once a customer, the competition is anyone in the company who wants to spend money. As we spoke about above, fundamental to all business is the allocation of limited resources. There is always someone who wants the money that is being spent on you. This is a pure business issue in many cases. Clearly, this isn’t always the case, but it is more often than not. What is the case for your company? You need to decide. Remember, this is a question, not an answer.

#5. How will the other organizations’ budgets/roles change?

Be warned, this is not typically a fun or easy discussion. Let’s go back to the topic of limited resources. What you get needs to come from somewhere. Everyone may support you 100% until the decision is made that the money will come from their budget. Remember the other people vying for resources aren’t evil. They believe that the reason the resources should be theirs is that their need is more important than yours. This is why these questions are so critical. People don’t understand customer success. There is no consensus on what it is, why it is, and what tangible, measurable value it will add.

Every once in a while I hear people complain about “Them”…

“They” don’t get it. “They” don’t think we should have a seat at the table. “They” etc. etc. etc. From my perspective the issue isn’t “Them”, it’s “Us”.

We want “them” to understand our role, its importance, the value we add and why it is possibly the most critical thing to the company’s future, but gaining an understanding of this is not their job. It is ours! We often talk about a “seat at the Table”. This is necessary, but not sufficient. What is really needed is a voice at the table, which requires you to speak the language at the table. That language is one based in numbers, financial numbers.

My hope is that these questions will help you become a bit more fluent in the language of the table. That your efforts to search for answers to these questions, to engage in the dialogue, will not only help you but the profession as a whole.

0 comments on “5 Questions You Need to Answer Before Investing in Customer Success”